News

-

Behind the Pay Stub: How Employers Handle Your Health Insurance

- 2025-09-15

- Category: Money & Well-Being, Risk & Protection

Understanding Your Employer’s Role in Covering Health Insurance Health insurance is a major factor in how we manage both our finances and well-being, and when it’s tied to your job, the dynamics become more complex. Employer-provided health coverage can offer better prices and broader access, but not all plans are created equal. If you’ve ever

-

Beyond Insurance: Why Loans Are the Real Engine of Post-Accident Recovery

- 2025-08-22

- Category: Money & Well-Being, Risk & Protection

Loans for Recovery After Technogenic Accidents When a technogenic disaster strikes — think of oil refinery explosions, chemical leaks, train derailments, or large-scale industrial fires — the damage goes far beyond the immediate area. Lives are disrupted, ecosystems may be poisoned, and businesses come to a halt. Infrastructure collapses under the strain. Yet amid the

-

Farming, Finance, and the Map: How Place Shapes Organic Loan Viability

- 2025-07-20

- Category: Loans & Lending

The Role of Geographical Location in Organic Farming and Loan Demand Organic farming isn’t equally viable everywhere. Regional differences in climate, soil, water, and even culture create sharp contrasts in how successful — or costly — it is to pursue organic agriculture. In ideal regions, going organic aligns with both the land and the market.

-

The True Cost of Borrowing: How to Know When a Business Loan Makes Sense

- 2025-06-26

- Category: Credit & Ratings, Loans & Lending

Whether to Take a Business Loan: Risk Analysis Business loans are both a powerful tool and a significant responsibility. They allow you to grow faster, bridge financial gaps, and seize opportunities that would otherwise be out of reach. But every dollar borrowed needs to be paid back — with interest. So, the question isn’t just

-

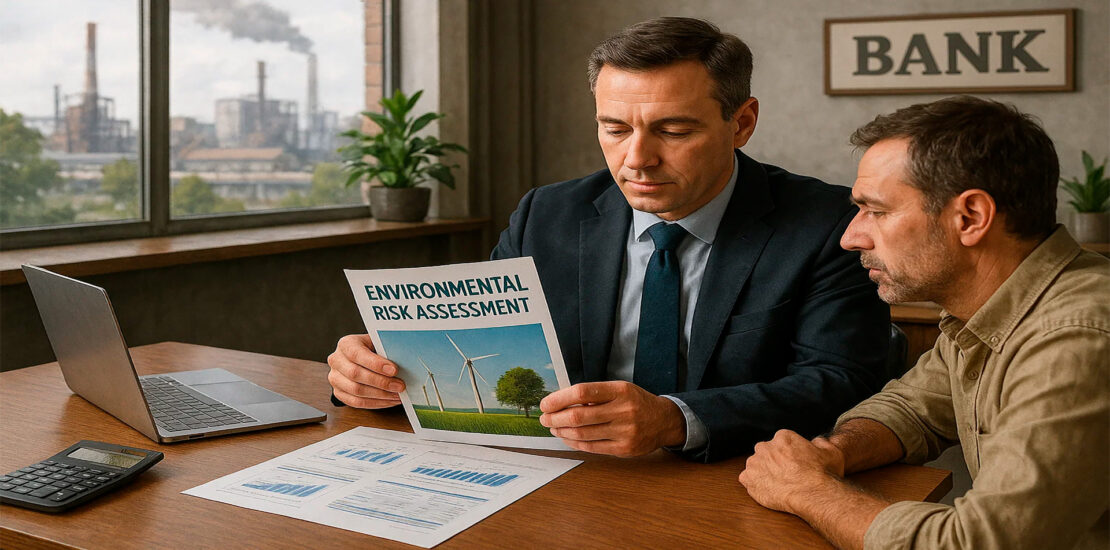

Green Risk, Real Money: How ESG Shapes Business Lending

- 2025-05-30

- Category: Loans & Lending, Risk & Protection

How Banks Assess Environmental Risks in Lending Loan decisions aren’t made in a vacuum anymore. Banks no longer look solely at profit margins, debt ratios, or revenue projections. They now evaluate something more abstract, but increasingly urgent: your environmental footprint. This change in how lending works has grown out of necessity. Climate change, tighter environmental

-

Designer Dogs and Dream Weddings: The Financial Pitfalls of Exotic Loans

- 2025-05-02

- Category: Loans & Lending, Money & Well-Being

Exotic Loans: Weddings, Pets, Funerals – Where Is the Boundary of Reasonableness? Borrowing money used to be about major life goals — buying a house, starting a business, covering education costs. But now, loans have crept into the everyday and the emotional. You can finance your dream wedding, pay for a designer dog, or even

-

Why Credit Ratings Drive Loan Terms and Boardroom Decisions Alike

- 2025-04-05

- Category: Credit & Ratings

Credit Ratings for Corporations: How They Affect the Cost of Borrowing When companies borrow money, it’s not as simple as signing a form and receiving funds. Lenders want a clear picture of a company’s ability to repay — and that’s where corporate credit ratings come into play. These scores reflect a company’s creditworthiness and can

-

The Truth About Credit Insurance: What You’re Really Paying For

- 2025-03-11

- Category: Credit & Ratings, Risk & Protection

How Does Credit Insurance Work and Is It Worth Getting? Credit insurance sounds like a safety net — and in many cases, it truly is. But behind the promises of financial protection lie contracts full of nuances. While some people might benefit from this kind of coverage, others may find it expensive and overly complicated.

-

Are You Tired, or Just in Debt? The Overlooked Impact of Borrowing Stress

- 2025-02-15

- Category: Money & Well-Being

Financial Burnout and Loans: Where the Line of Personal Responsibility Is Drawn Debt isn’t just a balance on your bank statement — for many, it’s a constant mental weight. When payments pile up, stress skyrockets, and everything starts to feel unmanageable, you’re not just broke — you’re burnt out. Financial burnout is real. It’s that