- 2025-05-02

- Category: Loans & Lending, Money & Well-Being

Exotic Loans: Weddings, Pets, Funerals – Where Is the Boundary of Reasonableness?

Borrowing money used to be about major life goals — buying a house, starting a business, covering education costs. But now, loans have crept into the everyday and the emotional. You can finance your dream wedding, pay for a designer dog, or even cover funeral expenses. These targeted, purpose-driven loans seem tailored to meet life’s unpredictable needs. But when you take a closer look, many of them are fueled more by emotion and marketing than by reason. And they come with a long tail: years of monthly payments for moments that may last only hours. This shift in consumer finance deserves attention — and scrutiny.

The Surge of Niche Lending

Modern lending is no longer limited to one-size-fits-all personal loans. Lenders have dissected the consumer experience and now offer customized products for emotional milestones. Wedding loans, cosmetic procedure loans, funeral financing, and even pet loans are marketed with slogans about love, dignity, and joy — not cost or risk. They’re packaged to feel personal, compassionate, and fast.

Behind the emotional veneer are tight repayment terms, elevated interest rates, and often little to no financial counseling. Many of these loans operate in a grey zone — too small for regulatory attention but too common to ignore. These are debts born not of need, but of cultural expectations and personal impulses.

Weddings: Forever Memories, Temporary Money

Weddings have transformed into performance events. The average cost now often exceeds $30,000 in many developed countries. To meet this high bar, couples are turning to loans as a quick fix. Many don’t think of it as debt. They think of it as a way to create a perfect day. But the reality is harsher. These wedding loans often come with interest rates similar to unsecured personal loans, usually between 8% and 15% depending on credit scores.

While lenders highlight features like “no payments for 90 days,” the fine print includes compound interest, origination fees, and fixed monthly payments that can linger for years. Young couples start their lives together not with savings, but with liabilities.

Common Wedding Loan Terms

| Loan Amount | Average Interest Rate | Loan Term | Total Cost (Est.) |

|---|---|---|---|

| $20,000 | 10% – 14% | 5 years | $25,500 – $27,800 |

Pet Loans: Emotional Spending on Four Legs

Pet loans are booming, especially for purebred purchases, surgical treatments, and premium animal care. Many vet offices now offer in-house financing or partner with third-party lenders to help owners cover surprise medical bills. It’s a well-intentioned option, but it opens the door to overreach — both emotionally and financially.

Some borrowers take on pet loans with monthly payments exceeding their car insurance premiums. And unlike with cars or homes, pets can’t be resold if money runs out. Borrowers face emotional attachment and financial strain simultaneously — not a good combination for rational decision-making.

Pet Loan Examples

| Expense Type | Loan Amount | APR | Monthly Payment |

|---|---|---|---|

| Breed purchase | $3,000 | 12% – 18% | $140 – $160 (24 months) |

| Emergency surgery | $5,500 | 10% – 15% | $260 – $290 (24 months) |

Funeral Financing: Debt in a Time of Loss

Death is non-negotiable, but the financial response often isn’t. Funeral loans are pitched as dignity-preserving solutions when families don’t have savings. It’s a sensitive, emotional time — which is why it’s also a vulnerable one. Grieving people may not compare costs or consider lower-cost options. Lenders step in with fast approvals and direct payments to funeral homes.

But the loans aren’t always reasonable. Rates can hit 20%, and the repayment terms often stretch into three or five years. Families who just lost a loved one are left paying interest on caskets, catering, and burial plots. What starts as a way to cope can turn into a source of lasting regret.

Why Lenders Love Emotions

The emotional borrower is the ideal borrower — less likely to scrutinize details, more likely to act fast. Lenders use urgency and sentiment as pressure points. Advertisements for wedding loans talk about fairy tales. Pet loan campaigns show smiling dogs and grateful owners. Funeral loan sites promise peace of mind. All focus on the feeling, not the finance.

It’s no coincidence. Financial institutions know emotional spending is sticky. The borrower’s commitment isn’t just financial — it’s personal. And that makes them more willing to stick with a payment plan, even when it hurts.

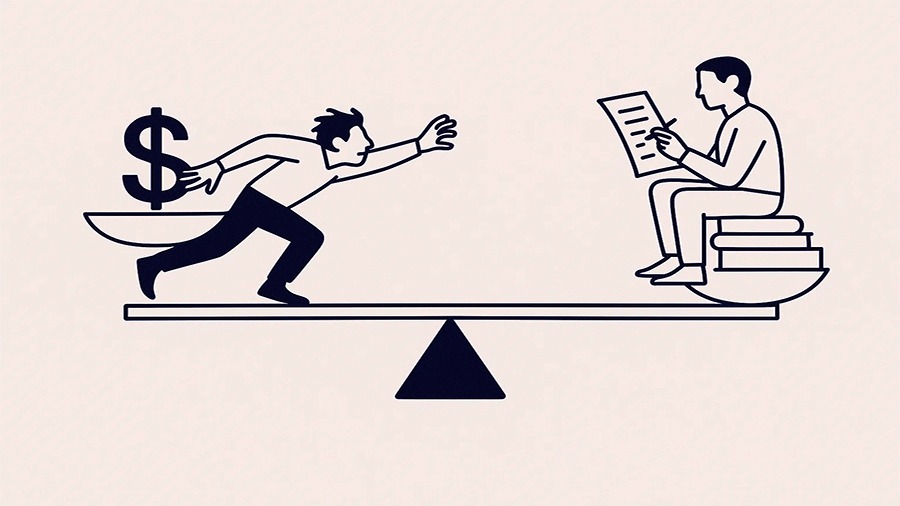

Impulse vs. Planning: The Danger Line

Not every exotic loan is predatory. Some offer a lifeline in moments of urgency or trauma. But the line between smart borrowing and emotional overspending is razor-thin. What determines success is context: was the loan part of a broader plan? Or was it a heat-of-the-moment choice driven by social pressure, guilt, or fantasy?

The problem is that repayment always happens later — when the emotion fades and the financial hit remains. A $200 monthly payment may not sound like much today, but add in job loss, inflation, or other debts, and it becomes a serious burden.

Better Alternatives Exist

Borrowers often overlook alternatives that could reduce financial strain. Installment plans directly from service providers usually carry no or lower interest. Short-term lines of credit from banks may offer more transparent terms. Some non-profits offer grants or emergency funds for veterinary or funeral expenses. Crowdfunding is another option — imperfect but less risky than high-APR debt.

- Talk openly about budget: Communicate limits with family members before big events.

- Delay non-urgent purchases: Waiting even 30 days can shift perspective.

- Start small: Instead of borrowing for everything, save for part of the cost.

- Plan ahead: Create emergency savings that cover emotional moments, not just logical ones.

When Does It Make Sense?

There are scenarios where exotic loans might be the only or best path. If your pet needs immediate treatment and you lack savings, financing could be humane and practical. If a funeral must happen now and help isn’t available, a loan can preserve family dignity. And yes, for some couples, borrowing to have a wedding that aligns with deep cultural expectations is not reckless — it’s meaningful.

But the decision must be deliberate. Emotional context shouldn’t replace financial logic. Borrowers need to approach these loans the same way they would any large purchase — with full awareness of trade-offs and long-term impact.

Regulation and Industry Response

So far, exotic loans operate in a light-touch regulatory space. But that may be changing. Consumer advocates are pushing for stronger disclosure laws, advertising restrictions, and even waiting periods before loan finalization. Financial watchdogs in some countries are beginning to collect data on niche loan defaults and borrower distress. Some banks, meanwhile, are moving toward offering bundled financial education with these products.

Still, much of the responsibility falls on the consumer. Understanding the emotional triggers and pausing before signing can make all the difference. As exotic loans become more normalized, financial literacy becomes more important than ever.

Conclusion

Loans for weddings, pets, and funerals are no longer fringe offerings — they’re a booming part of the consumer lending market. But their very nature makes them risky. Emotional decisions tend to ignore interest rates and repayment plans. Lenders know that. So the burden shifts to the borrower to draw the line between what’s meaningful and what’s manipulated. Exotic loans might help you celebrate love or process grief, but they should never cost more than you can afford — emotionally or financially.